pay indiana state property taxes online

On this site youll find the following personal property forms. Find Indiana tax forms.

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Individual Tax Return IT-40 Payment.

. Ad Find Property Ownership Records from Any State with a Simple Online Search. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax account s in one convenient location 247. 800 AM - 400 PM.

Take the renters deduction. Under non-bill payments click your payment method of choice. Claim a gambling loss on my Indiana return.

Pay your tax liability with a third party provider via credit card. Scroll down and navigate to Make a Payment in the Payments section. Know when I will receive my tax refund.

Follow the instructions to make a payment. INTAX only remains available to file and pay special tax obligations until July 8 2022. Pay my tax bill in installments.

You can pay your property tax by mail. For additional information please contact the Floyd County Treasurers Office. If you dont have a bill or dont know the amount due you can get assistance by calling the Indiana Department of Revenue at 317-232-2165.

Update Tax Billing Mailing Address. Pay Property Tax Online. How To Pay Indiana State Taxes.

Call 855-423-9335 with questions. Pay your full property tax bill via a participating bank. If your Property is up for Tax Sale making payment online WILL NOT remove it from the sale.

Please put the address of your tax payment in the box provided. See Results in Minutes. Building A 2nd Floor 2293 N.

Bank or credit card. E-checks will incur a convenience fee of 150 per transaction. The Marion County Assessors Office locates identifies and appraises all taxable property accurately uniformly and equitably in accordance with Indiana law.

Have more time to file my taxes and I think I will owe the Department. Pay your taxes due on E-Filed and Paper Returns Assessments and Invoices. E-Check Visa Mastercard Discover and American Express accepted.

It looks like something has gone wrong. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. But dont worry were working to get it back on track.

Barbara Hackman Bartholomew County Treasurer. Youll be redirected to InTime or the Indiana Taxpayer Information Management Engine. Tax bills are only sent out once a year for payment of both installments of your taxes.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Property. Emergency Alerts and Public Notices System.

Indianapolis Marion County Payment Portal. Main Street Crown Point IN 46307 Phone. To pay the balance in full select the tax year below.

Have more time to file my taxes and I think I will owe the Department. Main Street Crown Point IN 46307 Phone. Having your purchases made with credit card is possible for two reasons.

La Porte IN 46350. Take the renters deduction. Convenience fees are collected by the processing company not Vigo County.

Innkeeper Form 2018 Property taxes in Cass County will be due Spring May 10 2022 and Fall November 10 2022. In addition to the property tax amount you have paid this amount will be charged total 9500. You need to come in the office and bring cash or certified funds.

Agriculture Indiana State Department of. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Search for your property.

La Porte County Government accepts online payments for Traffic Tickets Probation Fees Property Taxes and more. Claim a gambling loss on my Indiana return. Know when I will receive my tax refund.

Chemist. General Contact Info Howard County Admin. The state Treasurer does not manage property tax.

You will be redirected to a payment portal. Please contact your county Treasurers office. If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number.

INtax only remains available to file and pay the following tax obligations until July 8 2022. DiscoverNovus MasterCard Visa or American. There are several ways you can pay your Indiana state taxes.

Form 102 - Farmers Tangible Personal Property Assessment Return State Form 50006. Both third party providers will charge a convenience fee that is determined by the provider and may varyACI Payments. Search by address Search by parcel number.

File Homestead and Mortgage Deductions Online. 124 Main rather than 124 Main Street or Doe rather than John Doe. Community.

To make a payment toward a payment plan or an existing liability or case click here. A representative can research your tax liability using your Social Security number. Animal Health Board of.

If you have any questions please call the office. Please direct all questions and form requests to the above agency. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes.

Center 220 N Main St Kokomo IN 46901 Open Monday-Friday from 8am-4pm. Pay online with MyAlabamaTaxes to avoid transaction fees. Find Indiana tax forms.

For best search results enter a partial street name and partial owner name ie. 2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation Property Tax Payments - Search. Make an Online Payment.

To make an online payment for a traffic ticket you received please click on the link below. Welcome to the State of Indiana Personal Property Online Portal PPOP-IN a convenient online portal through which taxpayers can file their personal property returns. You will not incur a service fee if you are an individual who uses eCheck as their method of paying their taxes online.

In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6-65. To view and pay your Property Taxes online please click on the link below. MAY 10 2022 SPRING INSTALLMENT DUE AND NOVEMBER 10 2022 FALL INSTALLMENT DUE.

4TAX 4829 or 1888. Look Up Any Address in Indiana for a Records Report. 29 1 minimum charge.

Tax bills are set to be mailed out Friday April 14 2022. You can pay your property tax over the phone by calling 317327. Pay my tax bill in installments.

Please contact your county Treasurers office. The Indiana Department of Revenue does not handle property taxes. Credit and debit card transactions will incur a convenience fee of 235 of your total tax liability.

State Income Tax Rates Highest Lowest 2021 Changes

Where S My State Refund Track Your Refund In Every State

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

Property Taxes By State County Lowest Property Taxes In The Us Mapped

A Visual History Of Sales Tax Collection At Amazon Com Itep

Dor Owe State Taxes Here Are Your Payment Options

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Ricevimenti Valutazione

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Irs Taxes Payment Plan Darien Il Www Mmfinancial Org Irs Online Taxes Tax Payment Plan

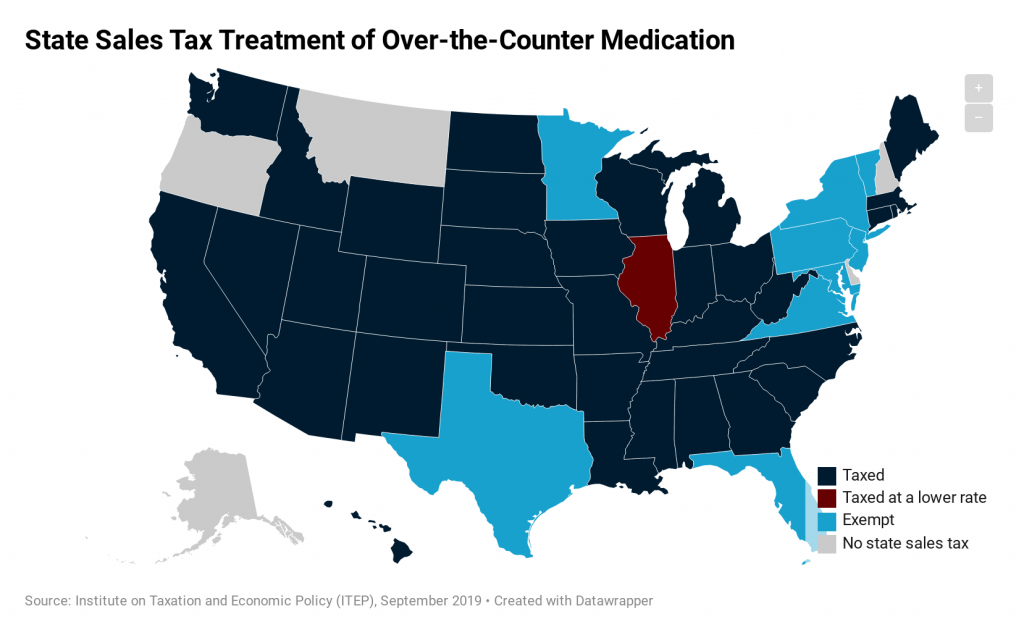

How Do State Tax Sales Of Over The Counter Medication Itep

How Do State And Local Individual Income Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)